3 Tips to Increase Your Chances of Getting Approval for Your Prior Authorization Request

Demystifying the insurance process

As we all know, insurance requires you to preauthorize your upcoming surgery with them; in a sense, they are giving you permission for medical care. Without that, you’ll be stuck paying the bill.

Since we must submit our own preauthorizations, it’s in your best interest to know how the process works. You’ll need to work closely with your insurer, and you’ll have to advocate for yourself through the entire process.

The process feels like you’re on an emotional rollercoaster.

For this article, I’ll discuss:

How to identify and obtain your clinical policy.

How to get the most accurate information to satisfy your preauth requirements.

Where and how to submit your preauthorization.

First: Obtain and Read the Clinical Guidelines of the Coverage Policy

Insurance has a document that shows everything you need for your preauthorization.

The document looks a little different with each insurance, but overall, it has the same format.

Here’s a peak at what an insurance coverage policy heading looks like:

This one is a BCBS plan:

Here is a Cigna coverage plan header:

Note that they both:

Title the document as a medical policy

Identify it’s for Surgical Treatment of Lipedema (and often include Lymphedema)

Have an effective date and a next review date (so you know that it’s an active plan)

This document will be your guide to your preauthorization submission.

The best way to obtain your clinical policy is to call your insurance and ask for it. Be specific and use the insurance language: “I want a copy of your coverage policy for Lipedema surgery.

You might even be able to get the document through their website. A lot of insurers now have all of their policies available online.

Second: Submit Thorough and Accurate Info According to The Coverage Policy

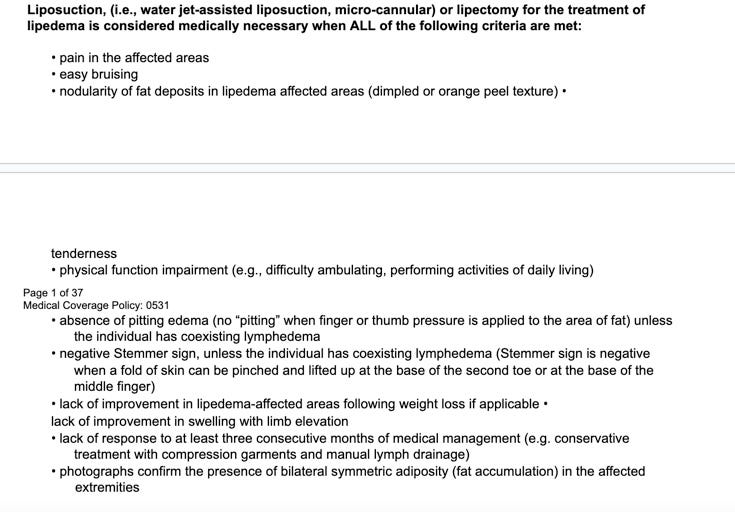

Let’s take Cigna policy for an example. In the body of the policy, you’ll find a list of what you’ll need to provide for your preauthorization:

These bullet points are indications that you’ll need CLINICAL DOCUMENTATION from specialists showing you have met all of the requirements. Getting treatment and gathering all of this documentation takes time, at least 3-4 months or longer. Some of these requests are nuanced, and you might not know how to show insurance you’ve met the requirement. That is when you get help from your surgeon’s office, your lymphatic therapist, or your patient advocate, who is assisting you with your preauthorization.

Another overlooked aspect is the detail of your preauth. If you have a misspelled name, the wrong ICD-10 code, CPT code, it can be immediately rejected. You’ll have to go through your preauth with a fine-tooth comb, and make sure all your T’s and I’s are crossed and dotted. It can be very frustrating, so be patient.

Third: Find Out How to Submit Your Preauthorization

I can’t tell you how many times I’ve heard people say they’ve had to resubmit their request several times because the insurance claims they hadn’t received it, or insurance gives wrong or conflicting information about how to submit your preauth. They will also claim that patients can’t submit their own preauth (untrue).

Insurances are notorious for giving incorrect or false information to their members. The only way I can recommend you get the correct info is to contact several different departments in your insurance company (not customer service, though, they won’t know). Some departments won’t talk to you directly, others will not know the answer to your question. This might be the most frustrating part of your process.

In short: Most insurances have a fax number you can submit your preauth. Also, a lot of plastic surgeon offices are coming up to speed with knowing how to do the actual submission and might do this for you—ask them! Some insurances have portals where providers will need to be added to submit claims, although there should be an alternative way for submission, especially for a specialized request with an out-of-network physician.

I used to recommend asking for a case manager at your insurance plan to help walk you through the process, but in the past year or so, insurances have been denying their members case management services, especially for Lipedema surgery.

You can still ask!

Having a contact person on the inside is very important, it’s what got me through my preauthorization approval. If you can find someone in the insurance to fulfill this role, you’ll have a much easier time!

Take care,

Michelle

Great Information which I need!!