What Does an Insurance Coverage Policy for Lipedema Surgery Look Like?

Here's a breakdown of the most important document you'll need for your surgical preauthorization.

If you’ve seen my social media videos, you’ve likely seen me talk about calling your insurance to ask for your coverage policy for Lipedema. It’s one of the most important documents for your insurance approval, and it’s imperative to know if your insurance has any coverage policy in place before you start the preauthorization process.

But how do you know what the coverage policy looks like? How would you know if you got the correct document?

I’ll show you coverage policy examples using actual policies from insurance companies. At the end of this article, I have links to those policies.

So, buckle in and put your thinking cap on! It’s going to be a crazy, complicated ride!

Every medical insurance policy is generally laid out in the same way. Here is a step-by-step through each section.

Coverage Policy Title:

A legitimate Policy Coverage will have a distinct layout. It will first have a title.

Although each policy looks a little different visually, they start with an intro to the policy they’re addressing.

“Corporate Medical Policy: Surgical Treatment for Lipedema”

“Liposuction for Lipedema”

“Clinical Policy: Liposuction for Lipedema”

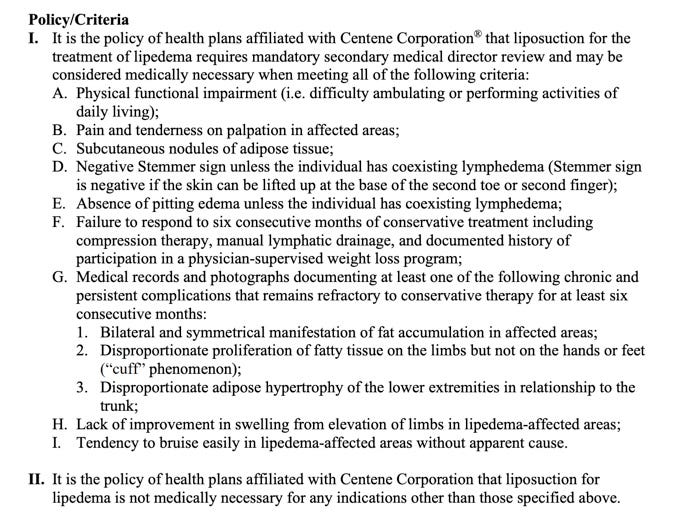

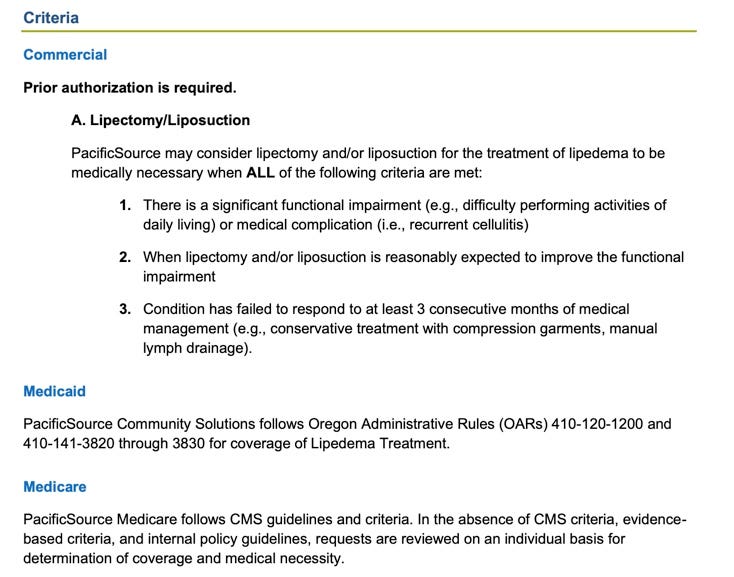

Policy Criteria:

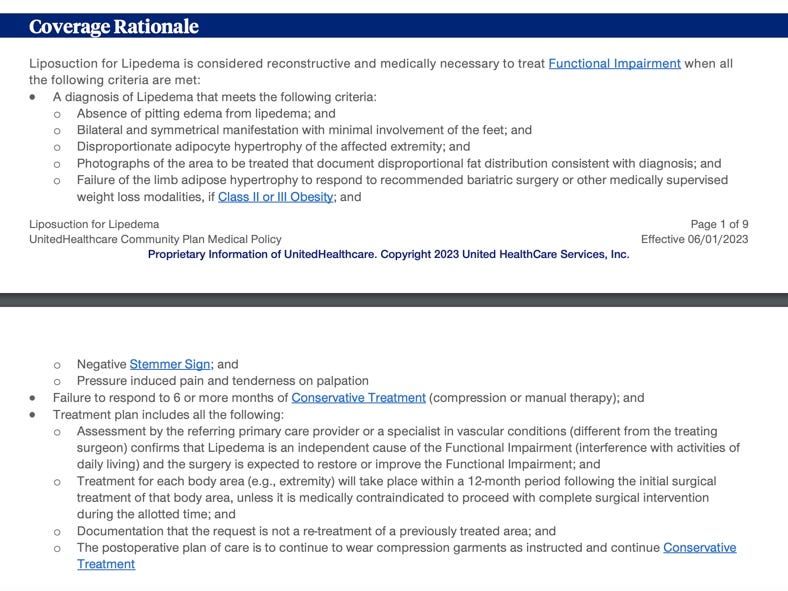

In the body of the policy, there’s a list of criteria you must meet before you submit your request to your insurance plan. This is the meat of the policy plan! This is why you must complete 3-6 months of Conservative Treatment; the insurance policy requires it.

As you can see, the criteria are listed in bullet points. This section of the policy drives your documentation of conservative care. You must meet all of the listed requirements under your policy and with documentation to send in with your preauthorization request.

Notice the last plan requires three months of conservative treatment, while the other two policies require six months.

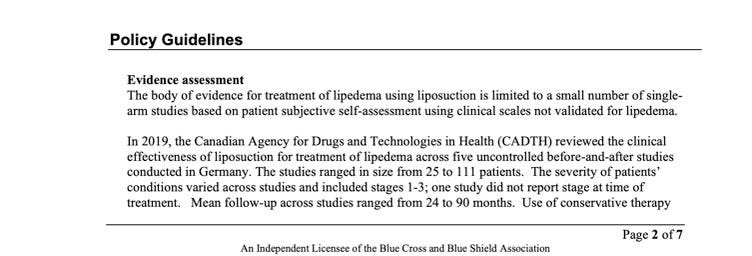

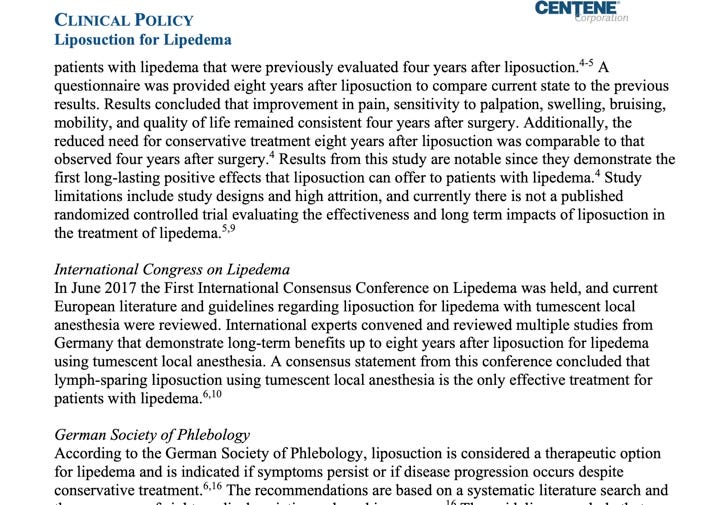

Policy Guidelines

The next section of Policy Coverage addresses evidence-based research and clinical practice.

The two above examples show the verbiage insurance uses in their policies. This part of the policy is for backing up the criteria they require for liposuction.

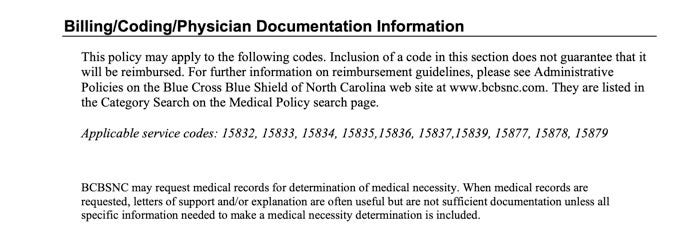

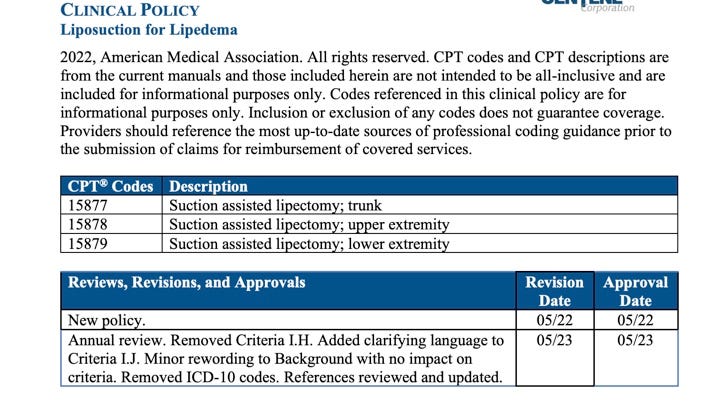

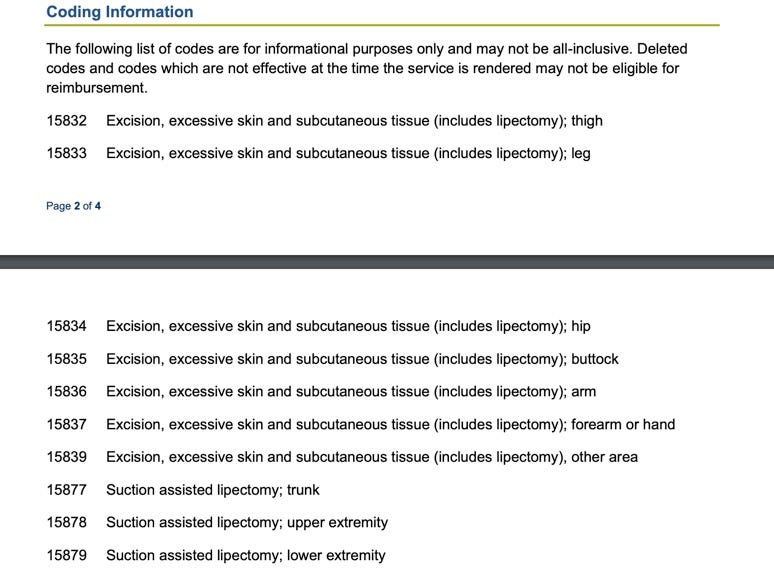

Billing and Coding/Diagnosis and CPT codes

Each medical treatment has diagnosis codes and CPT codes. This is how insurance processes medical bills. If a wrong diagnosis or CPT code is given, insurance will kick it back to the doctor as incorrect and not pay the claim. Here’s what they look like:

CPT codes are used for the surgical procedure. CPTs can also have modifiers, which can get a little complicated. These examples are here so you can recognize them when looking for your insurance coverage policy.

After the coding info, they will attach references.

If you want to see each of these three policies in full, here are the links:

PacificSource Clinical Policy for Lipedema

United Health Care Policy for Liposuction for Lipedema

Centene Health Policy for Clinical Lipedema

Caveat: If any of these Coverage Policies are under a similar name as your plan, it does NOT mean this is your insurance. You will have to call your plan and ask for the coverage policy.

Lipedema and Lymphedema Coverage

I’ve shown you these three simple coverage policies, which are helpful. However, some plans will lump Lipedema and Lymphedema together. The Cigna plan below does precisely this in its coverage policy.

Cigna Surgical Treatments for Lymphedema and Lipedema

How do you get a copy of your coverage policy for Lipedema? Call your insurance and ask for it! They are required to give it to you, and now you know what it looks like.

I often get asked, “Have you ever worked with (blank) insurance?” There are thousands of different insurance plans in our country, and there is no way anyone will have worked with every one of them, even if they tout that they have.

Instead, look for someone with experience reading insurance plan language, knowledge of medical reviews, and determining medical appropriateness. Claims review is also an excellent skill to have.

Guess what? I have all of these skills! I’m a medical insurance expert and love doing this work for Lipedema women. Just head to my appointment calendar and book a 25-minute slot to chat with me. There is a $40 fee, but you’ll get a wealth of information.

Don’t wait any longer! Let’s get started on your journey to better health together!

Find Lipedema and Me on TikTok, Facebook, Medium, and now on Instagram!

Take Care,

Michelle