Superbills 101: How to Get Reimbursed and Save Hundreds on Out-of-Network Care

Maximize your insurance benefits and save on out-of-pocket costs with this simple guide.

I’ve got some useful info for you that might not seem exciting at first—hey, it’s about medical bills and insurance, and that’s a mind-numbing topic—but stay with me! This information could save you hundreds on out-of-pocket expenses, so it’s worth knowing!

If you've ever seen a specialist or had care not covered by your insurance, you might have heard of a Superbill. It’s not really a bill, but a fancy receipt your provider gives you when they don’t bill your insurance directly. If you want to read more at length about superbills, here’s an article.

Use this receipt to submit a claim to your insurance and (fingers crossed!) get reimbursed for out-of-network care.

Here’s a Quick Run-Down on How a Superbill works:

You visit a healthcare provider who doesn’t bill your insurance directly (usually out-of-network). You’ll pay out-of-pocket for the visit. Ask for a superbill! They might not give you one unless you ask.

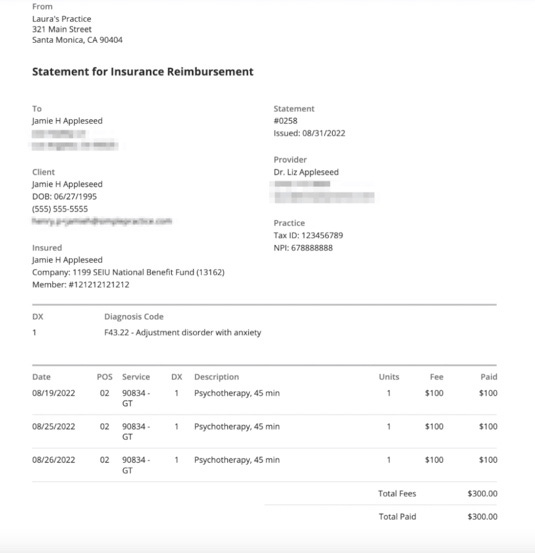

Obtain the Superbill: After your appointment, the provider gives you a receipt that should include at least the following to be considered a superbill: Contact info, date and cost of service, diagnosis codes, procedure codes

Submit to Insurance: You then send the superbill, along with any claim forms, to your insurance company to request reimbursement.

Review by Insurance: Your insurance company will check the superbill to see what’s covered. They’ll only reimburse a portion, depending on your plan and whether you’ve met your deductible.

Reimbursement: If all goes well, you’ll be reimbursed based on your coverage for out-of-network benefits.

What’s Included in a Superbill:

A superbill usually contains the following information:

Patient Information: Name, date of birth, and insurance policy details.

Provider Information: Name, address, National Provider Identifier (NPI), and Tax ID.

Service Details: Date of service, descriptions of the services provided, and associated procedure (CPT) and diagnosis (ICD-10) codes.

Fees: Breakdown of costs for each service or procedure.

Things to Keep in Mind:

Out-of-Network (OON) Coverage: Superbill reimbursements are usually for out-of-network providers, so it’s important to check if your plan offers this benefit. For example, a PPO plan often covers out-of-network care but at a lower rate, typically between 30% and 70%. On the other hand, plans like HMOs usually offer no out-of-network coverage at all.

Allowed Amounts: Keep in mind that insurance usually won’t reimburse you for the full amount on the superbill. Instead, they base reimbursement on their "allowed amount," which is often less than what’s on your bill. For example, a physician consult for a lipedema diagnosis may charge you $500, but your insurance may only allow $400 for the bill, and then cover the OON percentage rate for the allowed amount of $400.

Deductibles: If you haven’t met your out-of-network deductible yet, any amount on your superbill can go towards it—but remember, they’ll only apply the allowed amount, not the total bill. So, there might still be some out-of-pocket costs before your reimbursement kicks in.

Photo by Anastasiia Gudantova on Unsplash

Step-by-step Process for Superbill Reimbursement

Here’s how you can use a superbill to get reimbursed by your insurance for seeing an out-of-network doctor. Save this article to refer back to for when you have a lipedema consult (i.e. diagnosis or surgical), and the provider doesn’t directly bill your insurance (ask the provider ahead of time if they provide superbills):

1. Check Your Insurance Plan for Out-of-Network Coverage

Before you go to a doctor who isn’t covered by your insurance (called an out-of-network provider or OON), you need to see if your plan will help pay for it.

Look at Your Policy: Check your insurance paperwork or log into your account online. You’re looking for a section that talks about “out-of-network” or “non-participating” providers.

Call Your Insurance: If you’re unsure, call the customer service number on your insurance card. Ask them:

Does my plan cover out-of-network doctors?

How much will you pay for these services? (It’s usually a percentage)

Do I need to pay a certain amount first before you start helping (this is called a deductible)?

Do I need to get permission (prior authorization) first for out-of-network services?

What’s the most you’ll pay for certain services (this is called the allowed amount)?

Don’t be surprised if your insurance can’t or won’t answer some of these questions (insurance is notorious for being vague and dumb), but ask anyway.

2. Know the Important Details

If your plan covers out-of-network services, here’s what you need to understand:

Out-of-Network Deductible: This is the amount of money you have to pay on your own before your insurance starts helping. For example, if your deductible is $1,500, you’ll need to spend that much first before your insurance pays anything for out-of-network care.

Coinsurance: Even after you meet your deductible, you’ll still have to pay part of the bill. This is called coinsurance. For example, if your plan pays OON at 70%, you’ll pay the other 30%.

Allowed Amount: Insurance companies have set amounts they’ll pay for certain services, even if your doctor charges more. For example, if your doctor charges $200 but your insurance’s allowed amount is only $150, they’ll only pay a percentage of the $150, not the full $200.

3. Get the Superbill from Your Provider

When you visit an out-of-network provider, ask for a superbill. This is like a special receipt that shows everything you were treated for and how much it cost. Make sure the superbill includes:

The service codes (CPT codes) for each thing you were treated for.

The diagnosis codes (ICD-10) showing why you needed the treatment.

The doctor’s ID numbers (Tax ID and/or NPI).

The date and details of the visit.

4. Submit the Superbill to Your Insurance

Once you have the superbill, you need to send it to your insurance company to ask for money back (reimbursement). Here’s how:

Fill Out Claim Forms: Your insurance might have a form you need to fill out. You can usually find this on their website.

Attach the Superbill: Staple or upload the superbill with your claim form.

Submit Everything: Mail or email it to the address your insurance provides. Be sure to keep copies of everything.

Track Your Claim: After you send it in, check your insurance’s website or call them to see how it’s going. It can take a few weeks.

5. Get Your Reimbursement

If your insurance approves the claim, they’ll send you a check or deposit money into your account. They’ll pay based on their allowed amount and your plan’s rules. If they don’t approve it, you can ask them to review the claim again (appeal it).

Here's a Breakdown of the Math:

If you have met your deductible, this is what the breakdown looks like:

Your provider charges $500 for the visit.

Your insurance only allows $400 for this type of service.

Insurance covers 70% of the allowed $400, which is $280.

You pay $220 out of pocket ($500 - $280).

Total out-of-pocket cost: $220

The example above is pretty simple, but let’s imagine you go to a doctor who's not covered by your insurance, and the visit costs $500, but you still have to pay off your deductible.

Total visit cost: $500.

Out-of-network deductible: $1,000— but you’ve already paid $600 so far this year.

Allowed amount: $400 (what the insurance company considers reasonable for this service).

Insurance covers: 70% of the allowed amount after the deductible is met.

Remaining deductible: You still need to meet $400 of your $1,000 deductible ($1,000 - $600 = $400).

Out of pocket to cover deductible: The allowed amount for this visit is $400, which exactly matches what you still owe on your deductible. So, you’ll pay the full $400 out of pocket to finish meeting the deductible.

Insurance reimbursement: Since the $400 allowed amount fully covers your remaining deductible, your insurance won’t pay anything for this visit. If there had been a balance left after meeting the deductible, insurance would cover 70% of that amount.

You still have to pay the actual cost of the visit billed by the provider, which was originally $500.

Total out-of-pocket cost: $500

You’ll pay $400 to meet your deductible (from the allowed amount), plus an extra $100 since your doctor charged more than the allowed amount.

Even though you have to pay the entire cost of the bill, the advantage is that you have gotten it to count towards your deductible.

That was a lot of information, but it really shows how you can get your out-of-network lipedema providers covered by your insurance plan to help ease your financial burden.

Using a superbill can really come in handy, especially if you're seeing a specialist who’s not covered by your insurance. This can be a great reimbursement option for getting a lipedema diagnosis or even for surgical consults. It’s a way to get some of your money back from insurance rather than having to pay fully out of pocket for your lipedema care. It's just one more tool to help make your lipedema journey a little less expensive.

Take care,

Michelle